Unlocking the Best Medicare Advantage Plans in New Jersey for 2025: A Comprehensive Guide

Table of Contents

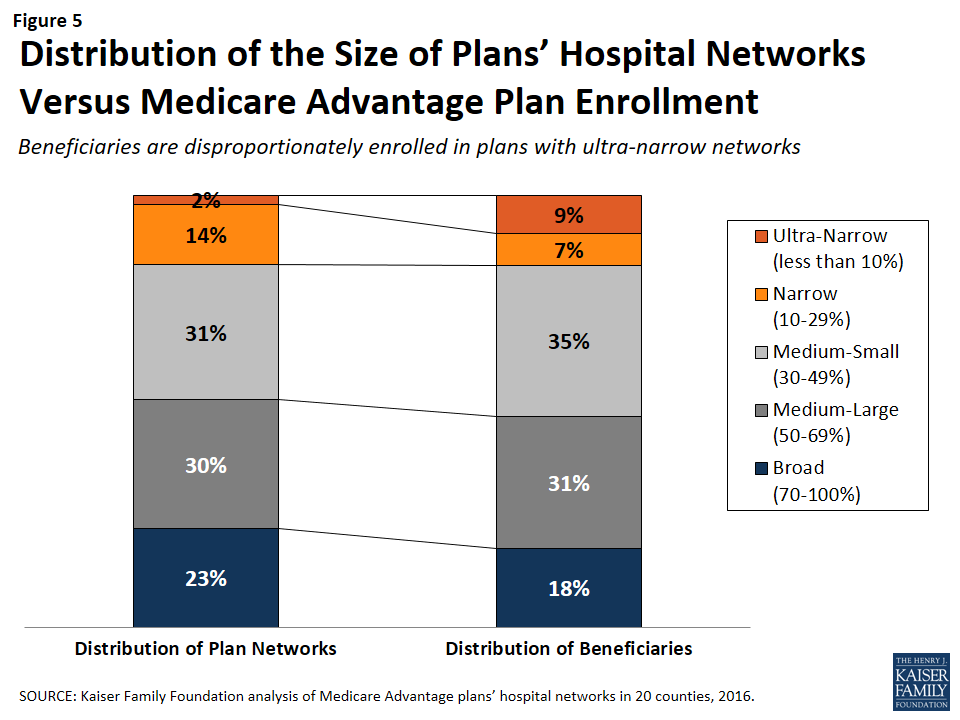

- Medicare Advantage Hospital Networks: How Much Do They Vary - Results ...

- Medicare Advantage Plans | Major Carriers | BroadZero | Philly & NJ

- Best Medicare Advantage Plans In Arizona 2024 - Matti Shelley

- Understanding Medicare - Horizon Blue Cross Blue Shield of New Jersey

- Top 10 Medicare Advantage Plans

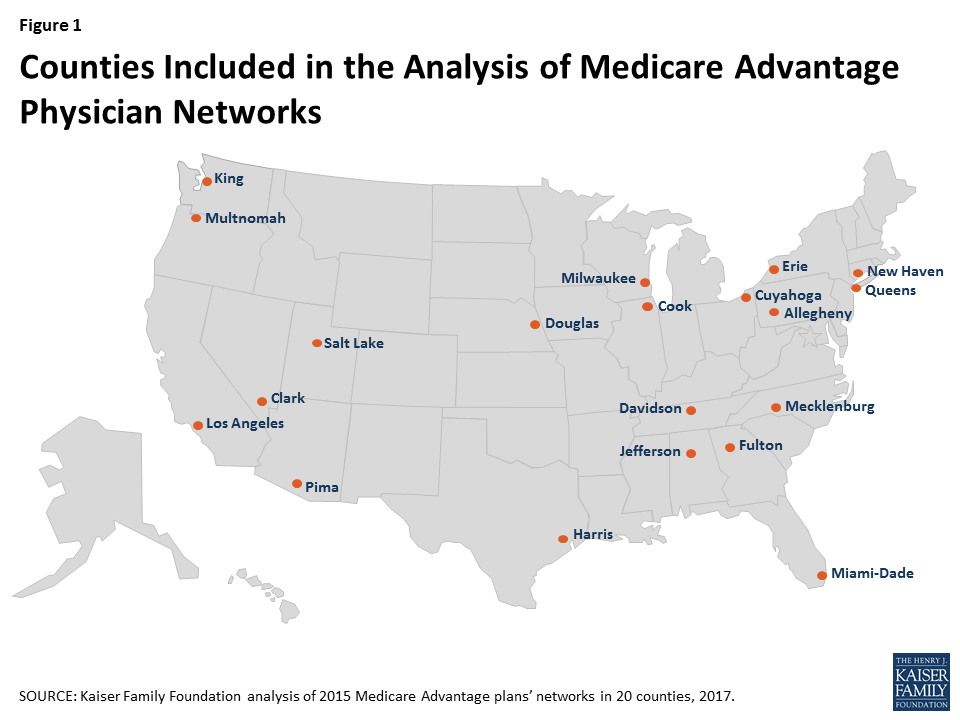

- Medicare Advantage: How Robust Are Plans’ Physician Networks? - Report ...

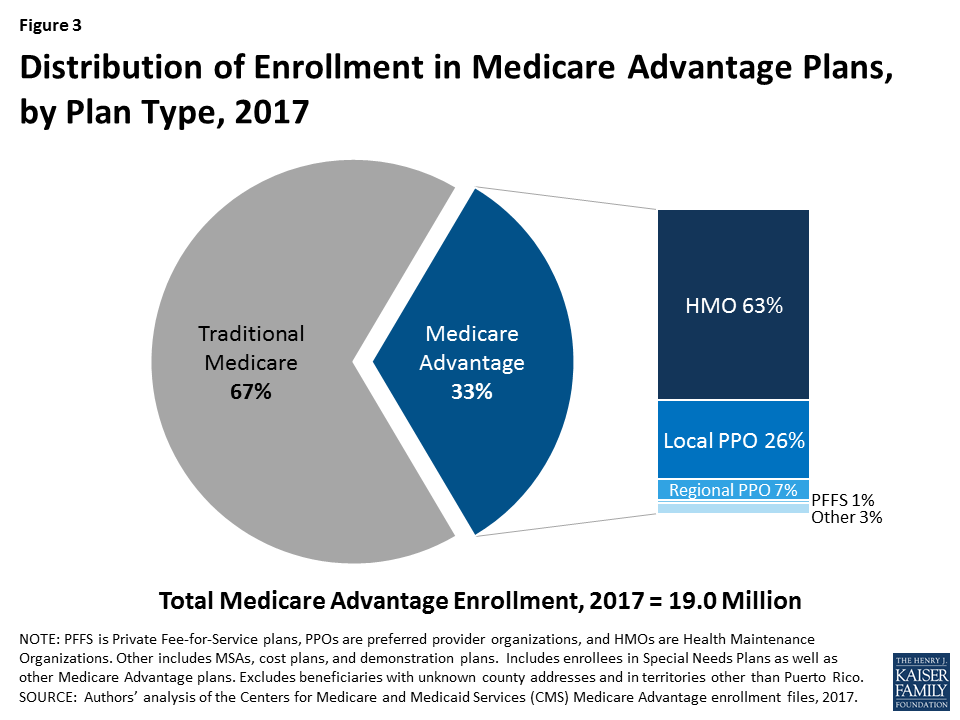

- Medicare Advantage | The Henry J. Kaiser Family Foundation

- Medicare Health Insurance Online NJ - Horizon Blue Cross Blue Shield of ...

- Medicare Advantage Plans by Zip Code 2025

- What is a Medicare Advantage Plan in Philadelphia? | BroadZero

Understanding Medicare Advantage Plans

Key Factors to Consider When Choosing a Medicare Advantage Plan

Top-Rated Medicare Advantage Plans in New Jersey for 2025

Based on plan ratings, benefits, and popularity, here are some of the top Medicare Advantage plans in New Jersey for 2025: Horizon Blue Cross Blue Shield of New Jersey: Offers a range of plans with varying levels of coverage, including the popular Horizon Medicare Blue Advantage (HMO) plan. UnitedHealthcare: Provides several Medicare Advantage plans in New Jersey, including the AARP Medicare Advantage Choice (PPO) plan, which features a broad network of healthcare providers. Aetna Medicare: Offers a variety of plans, including the Aetna Medicare Advantage (HMO) plan, which includes additional benefits such as dental and vision coverage. Humana: Provides several Medicare Advantage plans in New Jersey, including the Humana Gold Plus (HMO) plan, which features a range of benefits and a user-friendly online platform. Choosing the right Medicare Advantage plan in New Jersey for 2025 requires careful consideration of several factors, including network, out-of-pocket costs, and additional benefits. By researching and comparing top-rated plans from reputable insurance providers, you can make an informed decision that meets your healthcare needs and budget. Remember to review plan details, check ratings, and consult with a licensed insurance agent if needed to ensure you find the best Medicare Advantage plan for your needs in the new year.For more information and to enroll in a Medicare Advantage plan, visit the Medicare website or contact a licensed insurance agent in New Jersey.

Note: The information provided in this article is subject to change and may not reflect the actual plans and benefits available in 2025. It is essential to verify the details with the insurance providers and Medicare before making any decisions.